In March 2018, an Australian institutional investor walked away with some prized toll-road assets in India – on the Golden Quadrilateral in the first auction for toll-operate-transfer (TOT) bundles.

MIRA – Macquarie Infrastructure and Real Assets – had bid aggressively, almost 55% over the base price, and many thought it was a flawed decision. But not anymore.

MIRA’s portfolio is relied on by more than 100 million people every day. Their team of over 800 people invests in businesses that underpin economies and communities – aiming to add real and lasting value for our clients and the people these assets serve. MIRA manages $US129 billion in assets, including: 155 portfolio businesses, approximately 600 properties and 4.7 million hectares of farmland.

MIRA is part of Macquarie Asset Management (MAM) – the asset management arm of Macquarie Group. As at 31 March 2019, MAM had more than $US385 billion of assets under management.

It may just have picked up some of National Highways Authority of India’s best assets. Toll collections are likely to exceed expectations, reveals an analysis of FY19 figures.

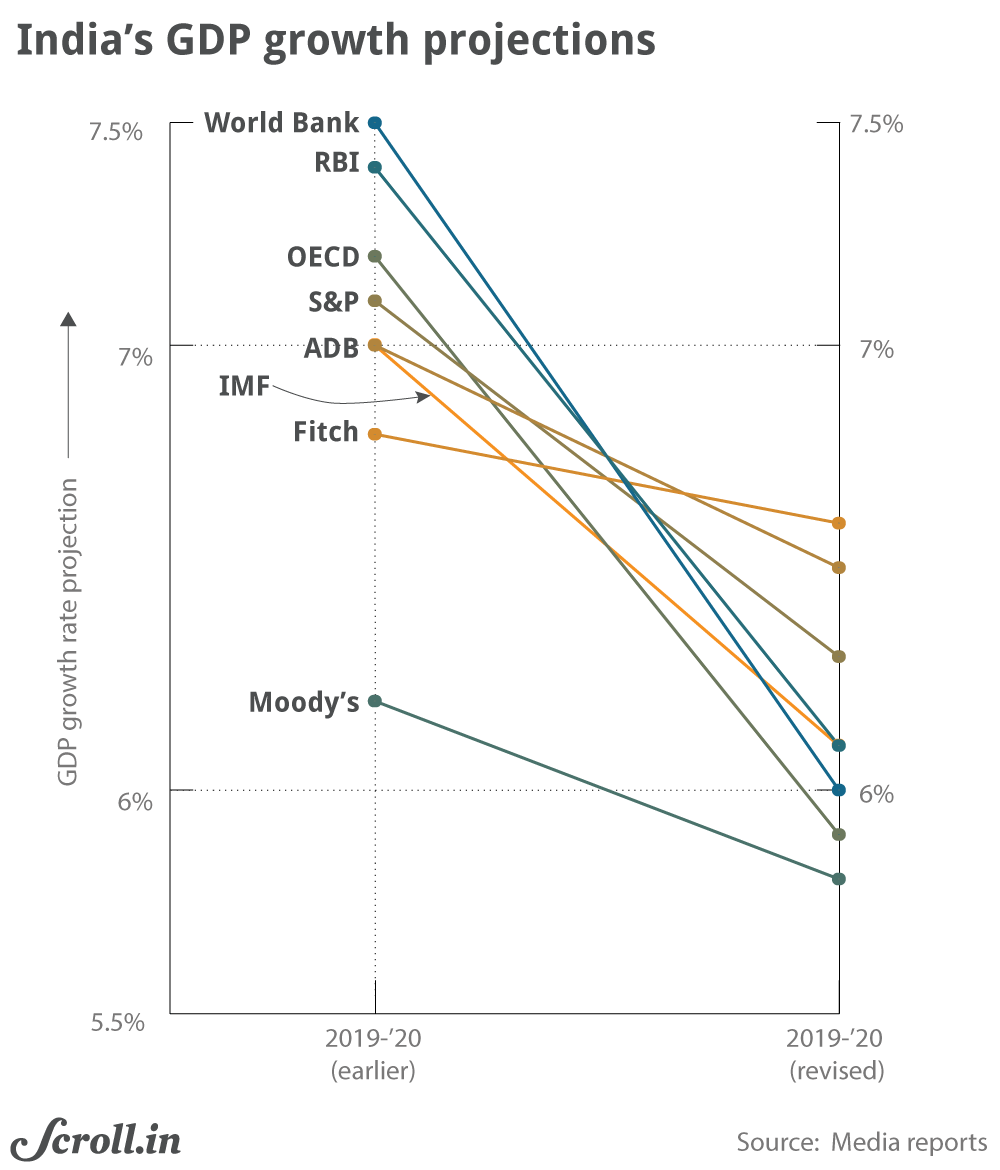

In India, MIRA has found a way to participate in the “growth story”.