In the next two years, the Indian food-tech industry is expected to reach the US$8 billion mark, according to a report by Google and Boston Consulting Group (BCG).

The food tech space has been the fastest growing e-commerce segment in terms of reach and engagement, on the back of the rapid advancement in internet adoption and continued investments on consumer trials and delivery satisfaction.

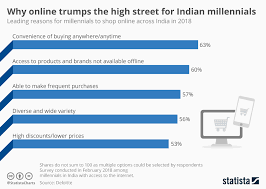

According to the report, titled ‘Demystifying the online food consumer’, the major reasons for growth in the use of online food ordering apps includes a large variety of cuisines, good discounts and convenience.

It said, “In fact, once users are satisfied with the service and start becoming habitual, they become more discerning about value – this behaviour is observable independent of town, class, social status, age and gender.”

Food tech is now in more than 500 cities in India.

Mr Rachit Mathur, MD and Partner, India Lead of BCG’s Consumer & Retail Practice added, “Overall online spending in India is rising rapidly and expected to grow at 25 per cent over the next five years to reach over US$ 130 billion.

“Riding on the wave of rapid digitization and steadily growing consumption, the reach of food-tech companies has grown six times over the last couple of years and will continue to increase further.”

The report is based on feedback of about 1,500 respondents across 12 cities.