INTO INDIA is optimistic that some deals will emerge from the current round of talks on the Australia-India Comprehensive Economic Cooperation Agreement (CECA) – spearheaded by Australian Trade, Tourism and Investment Minister Dan Tehan and, Commerce and Industry Minister Piyush Goyal.

But a look at Australia’s stance and recent Indian trade policy actions is not reassuring.

India withdrew from the negotiations for the Regional Comprehensive Economic Partnership (RCEP); it renegotiated a number of its free trade agreements; it terminated most of its bilateral investment agreements; and it has failed to agree a mini-economic deal with the United States. Not to mention India’s stance in the World Trade Organisation which has been unchanged.

At the domestic level, India has imposed prohibitive tariffs in several sectors and introduced a range of incentives to attract reshoring and investment.

How does Australia’s record stack up? Eager to send more resources and agriculture to India, Australia has been reluctant to allow great services access and people movement from India. This is a thorny issue.

So our word is CAUTION – don’t get your hopes up too high – there has been little progress to show after ten years of negotiations.

So, why be optimistic now?

First, Australian professional trade negotiations have loosened up on what was a cornerstone article of faith for them – preferring the “single undertaking” negotiating model – in which nothing is agreed until everything is agreed. Now even they are talking about “early harvest” deals. But can they change their spots? The Morrison government, desperate for a trade win, hopes they can.

Second, India has direct concerns about China and is nervous about the US-China rivalry. It has sensibly decided to build up strategic and economic partnerships as a hedge. There is much talk in India about potentially good trade outcomes arising from China’s “trade war” on Australia.

But the stalemate is always market access.

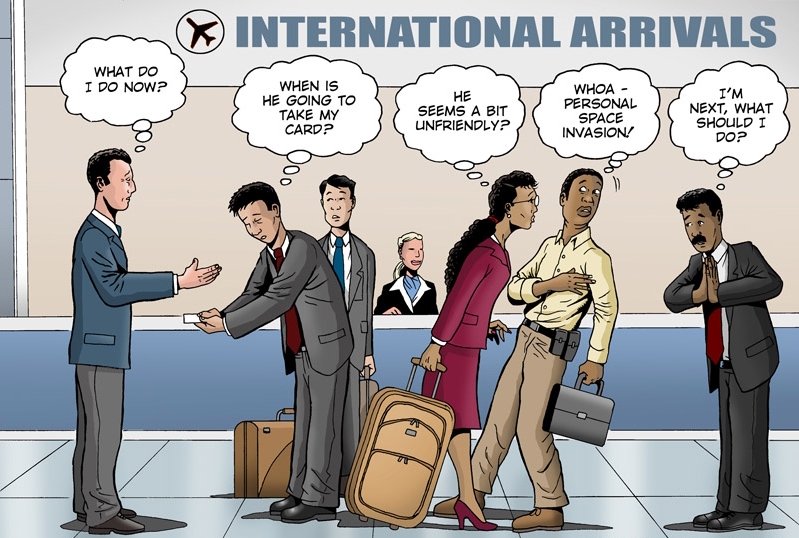

Australia wants agriculture access – India is hesitant because this sector employs 40% of India’s population. India wants liberalisation of the services “mode 4”, specifically the short-term entry of business persons. India has argued that Australia’s short term business visitor regime constitutes a barrier to India’s services exports. Australia has pushed back on these demands, reflecting concerns at the potential impact on the labour market. In a nutshell – one big stalemate!

Overall, India is not a fan of Free Trade Agreements, seeing most of them widening its trade deficit. That is, India feels the other party benefits most. It has negotiated on five FTA’s over the last 11 years and only one has been signed.

True, India is looking eager, having revived trade talks with the European Union, United Kingdom, United States and Australia. But is it all just a lot of talk?

Remember, India is primarily after foreign investment, exports, making domestic industries competitive and incentivise other countries to manufacture in India. Can Australia play a role in any of this?

The key for Australia and India is to somehow align Australia’s export goals with India’s investment and new exports priorities.

Australia could partner India on technology, innovation and R&D.

Australian companies could boost investment into India – and there are good economic and government subsidy reasons to do so.

Australia has one big advantage here – critical minerals. India has high sustainable energy and e-mobility goals and will need these minerals.

Add to that, Australia has growing expertise in the hydrogen industry, while India has a National Hydrogen Mission. There are good R&D opportunities for both.

While India is the “pharmacy of the world”, Australia is a leader in biotech R&D. Biotech in dairy, marine and more could provide trade deal motivation.

But finally, there is the big blockage.

India wants to increase skill migration to Australia. Australia has opposed it. Most of the talks in the last decade have faltered at this point.

What has changed?

Border closures have left Australian businesses struggling to fill roles. Australia needs an ‘early harvest deal’ to attract skilled professionals from India.

So, despite the gloom of the past, there are reasons to have some optimism for these talks on CECA.

Watch this space.