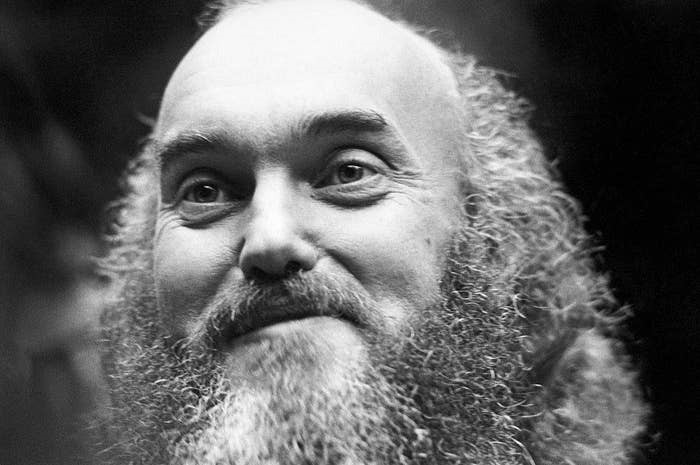

David Morris is a former Australian diplomat and current expert/advisor on regional issues, risk and international relations. He recently wrote on “The Belt and Road Initiative and the Geopolitics of the Pacific Region” published in Research on Pacific Island Countries, Social Sciences Academic Press (China), 2019.

The Belt and Road Initiative has become associated with a geopolitical “China threat” discourse in the South Pacific, he writes.

Are China and Australia, the dominant regional player in the South Pacific, driven by geopolitical imperatives to compete for power? Or do their different geopolitical needs provide opportunity for cooperation that is mutually beneficial and manages risks in the region?

As a commentator on India and the Indian Ocean, I can see much of what David Morris writes could be applied to the Indian Ocean rim countries.

Morris analyses supposed Chinese “threats” as well as risks to China, including fears of a military base in Vanuatu, Chinese debt-funded projects in Tonga and closer economic cooperation with Papua New Guinea.

He concludes that it is feasible for Australia to meet its geopolitical imperatives if its regional security leadership can be maintained.

A geopolitical analysis of China in the South Pacific concludes that China is unlikely to seek regional security leadership if it can ensure access to trade routes and markets.

If Australia could move beyond geopolitical rhetoric, it should therefore be possible for Australia to partner with China to support sustainable development, mitigate risks and ensure broader stability of the South Pacific region, he writes.

With large doses of common sense, Morris writes that Australian activity could be complementary to China’s BRI, and that while there are political risks, the two countries could cooperate to reduce risk and ensure projects are sustainable.

This would be great – but my view is a big barrier to anything Australia does in our region is always its world view of “goodies and baddies” with the USA as the major “goody” and China the current “baddy”.

It would be great if influential countries like India, Australia and China could create a new collaborative model that brings real development to those poor communities in our region.

Is this possible?