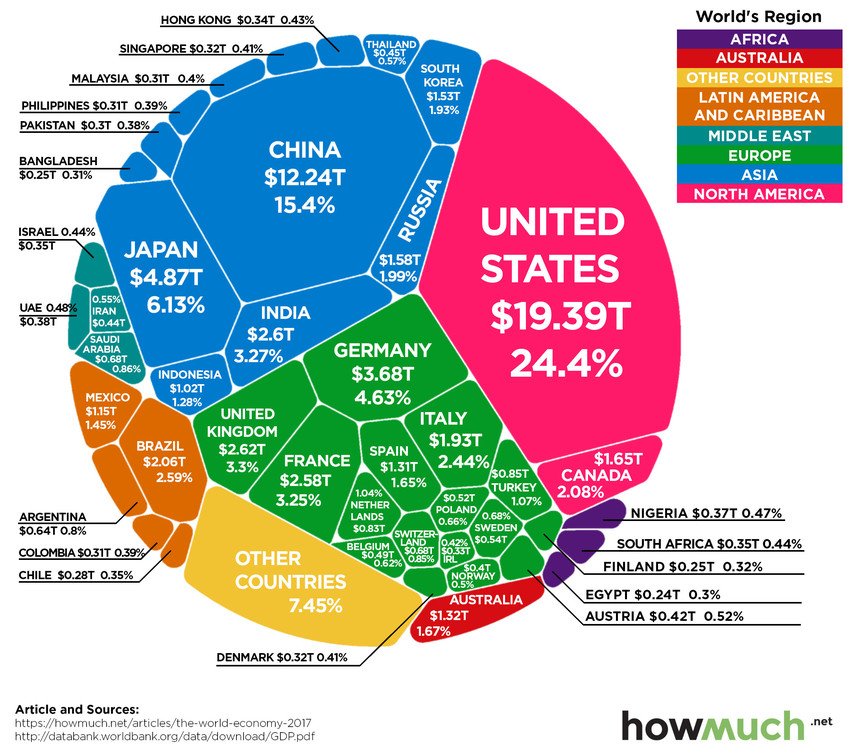

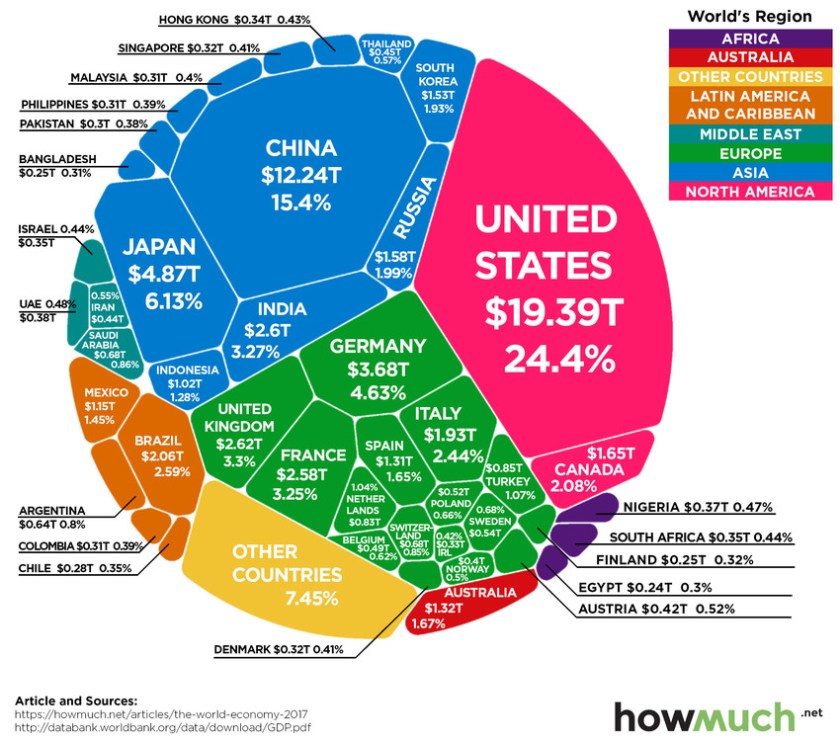

Have a go! India is already a large market and growing fast – with a massive young population driving future demand. Interest is growing in “all things western” and demand in many sectors (IT, education, resources) is just so big it cannot be satisfied locally.

Do your homework! Failures are many and most can be traced back to lack of research or inability to adapt to the local market. Factors such as cultural differences, consumer trends and what the market wants have to be identified.

Above Australian PM Morrison and Indian PM Modi hit it off at a recent meeting

Use our reputation! Australia is generally well thought of in India – those who come here are amazed at the quality of our cities. Use this for brand advantage and to open doors.

Choose the right channel. Distribution, e-commerce choices and so on will be make or break for you if consumers are your target. Aussie firm COTTON ON recently set up and online sales entry into India, the first step towards a physical presence.

India is a “relationship” culture – meaning they want to get to know you first. It might take several visits for you to create the connection. Otherwise you get a short term transaction this year that might not be there next.

Indians can help you! Finding local Indian talent has been a big success factor for so many global companies, large and small. If you cannot afford to establish a local team then perhaps you cannot afford to do business there.

Adapt to culture – get some training to understand how to behave and how your Indian counterpart might think. We are different! If you are culturally adaptive you can succeed and enjoy the difference.

Have both short term and long-term goals – and long term with India means committing to this venture for at least three years.

But above all – have a go!