Are you an FMCG exporter? Is India part of your plan?

According to market researcher Nielsen, India’s fast-moving consumer goods (FMCG) market is expected to grow 9-10 per cent in the January-December period, matching the expansion rate in 2019.

There are two shifts in the Indian FMCG market – one is to branded products and the other is to online e-commerce.

A shift towards branded products has been driven by the GST.

“Following the implementation of GST (Goods and Services Tax), a lot of unorganised players have exited the market across different FMCG categories,” said Mr B Sumant, ITC executive director of FMCG. “As a result, there has been a clear shift in consumption trend from unbranded to branded products.”

Pictured above – the top Indian FMCG stocks

FMCGs can be divided into several different categories including:

Processed foods: Cheese products, cereals, and boxed pasta

Prepared meals: Ready-to-eat meals

Beverages: Bottled water, energy drinks, and juices

Baked goods: Cookies, croissants, and bagels

Fresh, frozen foods, and dry goods: Fruits, vegetables, frozen peas and carrots, and raisins and nuts

Medicines: Aspirin, pain relievers, and other medication that can be purchased without a prescription

Cleaning products: Baking soda, oven cleaner, and window and glass cleaner

Cosmetics and toiletries: Hair care products, concealers, toothpaste, and soap

Office supplies: Pens, pencils, and markers

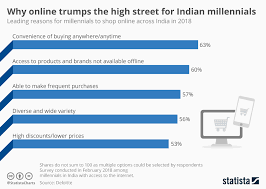

Shoppers in India are leaping from buying unbranded at “mum and dad” stores to online purchasing.

The most popular e-commerce categories, not surprisingly, are non-consumable goods—durables and entertainment-related products. The online market for buying groceries and other consumable products is growing, as companies redefine the efficiency of delivery logistics which shorten delivery times. While non-consumable categories may continue to lead consumable products in sheer volume, gains in logistics efficiency have increased the use of e-commerce channels for acquiring FMCGs.