More evidence that the Australian and Adani dream of selling coal to India is just a fantasy.

India is increasingly shifting towards green energy

Simon Mundy of the Financial Times reports that Indian power companies spent much of the past decade rushing to build coal-fired power plants in anticipation of surging electricity demand as economic growth took off.

You can see the article at https://on.ft.com/2GShz3Q

Now, many of those projects are mired in deep financial distress and private investment in coal power has ground to a near halt – making the Australian and Adani dream of selling more coal to India look deluded.

Mundy writes that the biggest driver of long-term uncertainty for the industry is one that few anticipated 10 years ago: an explosive take-off in the renewable power sector, as India joins the global push to tackle climate change by shifting towards green energy.

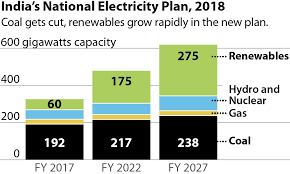

Soon after taking power in 2014, Prime Minister Narendra Modi’s government set a target of increasing India’s renewable energy capacity by 2022 to 175 gigawatts, equivalent to 40 per cent of the country’s total power capacity at the time of the announcement.

Indian coal power producers are considering renewable projects when they build new capacity © Getty

Mr Modi’s ambitions were stoked by a dramatic fall in the price of solar panels after a huge expansion of production in China, which is seeking to capitalise on the international drive to cut emissions. This was steadily making the cost of electricity from solar plants — once far more expensive than coal power — more competitive with plants running on the dirtiest fossil fuel.

Making a mockery of Australia’s long hopes of selling more coal to India, in the 2017 financial year, newly added renewable energy capacity overtook new coal-fired capacity for the first time. The renewable push attracted major investors such as Japan’s SoftBank, whose consortium last year sealed a deal that stunned the industry.

Mundy goes further on coal – this shift in the industry’s economics means that coal power — once one of the hottest prospects for Indian industrialists — is now a space where most fear to tread.

“You’d have to be quite courageous to invest in coal at this point,” said Navroz Dubash of New Delhi’s Centre for Policy Research.

Does Australia realise that India has plentiful supplies of coal in its eastern region?

This year, state-run NTPC — by far the biggest thermal power producer in India — has cancelled several plans for large coal projects, including one for a giant 4GW plant in southern Andhra Pradesh state.

Increasingly, large private-sector coal power producers are looking at renewable projects when they build new capacity.

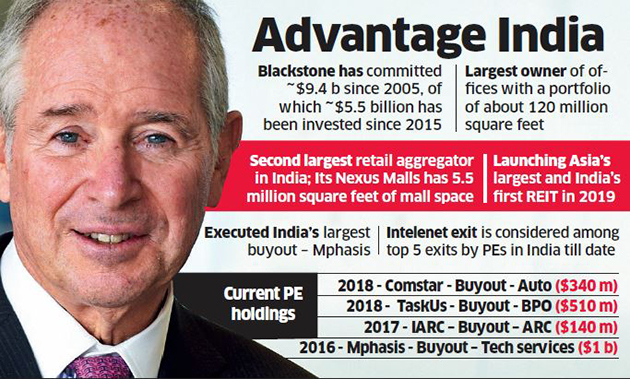

Even Adani, which is in big strife with plans to mine and export coal from Australia, has invested more than $600m in a solar plant in Tamil Nadu — a southern state with abundant sunshine.

There is no longer an economic case for the highest-cost coal plants in inland areas of the country’s south and west, which are forced to rely on coal expensively transported over long distances from the northeastern coalfields, said Tim Buckley at the Institute for Energy Economics and Financial Analysis.

Credit Suisse estimates that more than half the debt owed by power companies is now stressed — with interest payments exceeding profits — amounting to a total of more than Rs2.5tn ($35bn).

Several coal-focused power groups are being dealt with under India’s new bankruptcy code, which will force them into liquidation if a swift sale is not agreed. Indian authorities have an incentive to minimise the distress in the coal power sector. State-controlled banks, reeling from a surge in non-performing corporate loans, are heavily exposed to this industry.

But the Modi Government is clear in favouring renewables, leading to long-term self-sufficiency, lower costs, more competitive industry and better climate outcomes. Even though major corporates like Tata and Essar are struggling with the economics of coal power plants, the Government remains unwilling to shift from renewables.

Which makes the Australian/Adani dream of creating our biggest coal mine and shipping it all to India look like a case of sticking to an old fantasy while the target market has moved on. Can Australia move on too?

Because Australia is expected to commit about A$1 billion towards the scaled down A$5 billion mine project, the Australian Prime Minister and the Queensland Premier need to have some serious discussions with Adani Group – and possibly Indian Prime Minister Modi – to get answers to some disturbing questions:

- If Adani is simply planning to supply coal to its own power stations in India, what tiny fraction of the Carmichael coal reserve does this represent?

- Does Australia face the worst of all worlds with no royalties and vastly fewer jobs than expected?

- Exactly how many jobs will Adani Group commit to long term?

- What would be the environmental degradation costs of the project?

With these answers both governments can assess the risk of being left holding a distressed or potentially stranded asset of no value to anyone.

Right now our politicians seem to want to resist the future, rather than embrace it.